Blog

Spot The Difference…

How To Tell A Genuine FCA Authorised Site From A Scam Site 🔍 Spot the Scam: Huge Loan Lender vs.…

The Rise of ‘Too-Good-To-Miss’ Loan Scams

The financial scammer’s playbook is getting more sophisticated by the day. Last week, we looked at clone firms, fraudsters posing…

Loan Sharks in Disguise – The Rise of Clone Loan...

In an age where financial pressure is bearing down on millions, many turn to the internet looking for a fast…

The Hidden Costs of Everyday Life

Every day, we make countless small purchases without realising the impact they have on our finances. From that morning coffee…

Bully Badger: A Smarter Way to Manage Your Money

Badger Loans tries to give people access to quick and convenient financial solutions. But what if you could avoid borrowing…

Finding the Right Unsecured Loan

How Badger Loans Makes Finding the Right Unsecured Loan Simple – Even for Bad Credit At Badger Loans, we understand…

Is Interest on Loans Just ‘Fairy Money’?

Interest on loans: it’s one of those financial concepts we all think we understand but rarely stop to question. As…

The Potential Dangers of Central Bank Digital Currencies

Central Bank Digital Currencies (CBDCs) are digital versions of a country’s fiat or paper currency, issued and regulated by the…

Financial Wisdom and Ethical Integrity

In a world dominated by money and debt, it has become increasingly essential to cultivate financial wisdom alongside ethical integrity.…

Bad Credit Payday Loans Guide For 2024

Bad credit payday loans can provide a vital lifeline for emergencies where you need to access cash before payday comes…

Personal Loans UK Guide for 2024

Personal loans, in recent years have gained a lot of negative press, but if you fully understand how they work,…

New Payday Lenders UK 2024

New payday lenders appear and disappear all of the time, so it can be really difficult to understand the different…

Emergency Loans & Options for Bad Credit 2024 Guide

Emergency loans can offer the perfect solution when those unexpected and urgent financial emergencies arise. Emergency cash can be used…

Welcome To The All New Badger Loans!

Welcome to the all new Badger Loans! This is our attempt to give you an all singing, all dancing, slick…

Scam in Progress (and this is what it’s like)

Over three weeks ago, back on May 23rd, we were visited by an old acquaintance we hoped we’d seen the…

Reduce Financial Stress With These Tips

If you’re experiencing financial stress, you’re not alone. Covering monthly bills is a concern for many in the UK. While…

Make Borrowing Work For You

This month’s blog is about borrowing money without going broke and getting yourself into a whole world of trouble in…

5 Tips on Getting the Best Payday Loans

When you are in a financial bind, it can be difficult to know where to turn for help. If you…

A Recession-Proof Guide To Thriving in Uncertain Times

The economy may be in a downturn, but it doesn’t have to be all doom and gloom. You can protect…

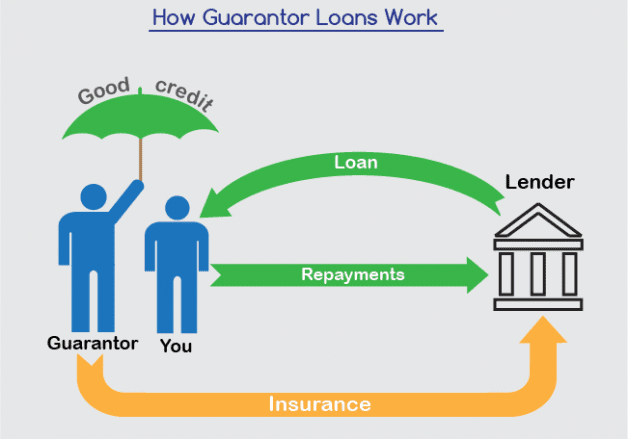

The Benefits of Guarantor Loans

Unfortunately since this post was published we no longer have access to any guarantor loan lenders. The information contained in…

The Benefits of Emergency Cash Loans

When you find yourself in a pinch and need money fast, there are few things more frustrating than not being…

What Is a Cash Advance

Should You Take Out a Cash Advance? A cash advance can be an effective way to get money fast in…

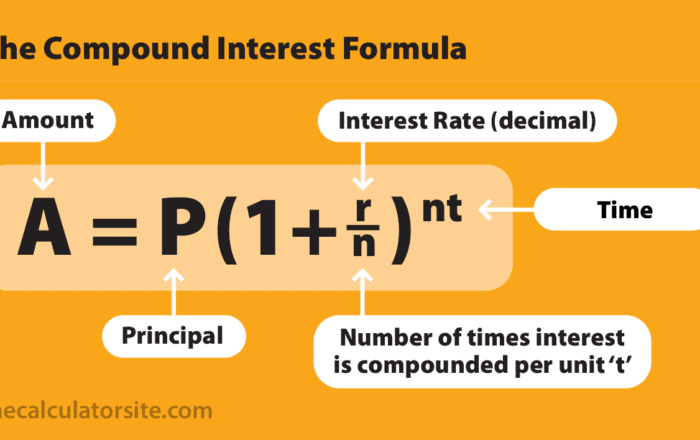

What Are Compound Interest Rates

Compound interest is the addition of interest to the principal sum of a loan or deposit. It is the…

How Do Payday Loans Work?

How Do Payday Loans Work? Short-term loans (otherwise known as payday loans) are quick cash solutions but are they really…

Bad Credit Loans UK 2024 Guide

Do you need a bad credit loan? How do bad credit loans work? What are they used for? Who can…

What is Debt Consolidation?

Should I Consolidate My Debt? Welcome to another Badger Blog Post. This week we’ll be looking at what is debt…

What To Consider Before Applying For An Unsecured Personal Loan

Given that an unsecured personal loan could last up to 60 months in total, it is vitally important to know…

Healthy Home Improvements

Looking To Improve Your Home? – Healthy Home Improvements If you’re looking to make some healthy home improvements – and…

New Payday Loan Lenders 2024

New Payday Loan Lenders 2024 Welcome to another Badger Loans blog post. Now is a good time to start looking…