Looking for a personal loan that fits your unique financial situation? Whether it’s for debt consolidation, home improvement, or even planning a wedding, our personal loans offer flexible solutions tailored to your needs. Borrow between £1,000 and £25,000 with fixed monthly repayments, and enjoy a quick, easy online application process. With funds available within 24 hours, you can tackle your financial goals faster than you think.

If you would like to take a deeper dive into the workings of personal loans you can read our new Guide to Personal Loans in the UK.

We have put together a series of helpful Finance Guides to help you make a more informed decision about loans in particular and finance in general. If used wisely they could help you get the loan you need at a more affordable rate.

What is a Personal Loan?

Badger Loans provides access to Personal Loans UK. A personal loan is a loan which is used for personal purchases and expenses. Whereas you would use a mortgage to purchase a property or a business loan to fund your business.

This type of product falls under unsecured loans because your eligibility is based on your income and credit status. There is no collateral or guarantor required.

Personal loans are often repaid in equal monthly instalments on a scheduled repayment date that you select each month.

Key Features

- Borrow from £1,000 up to £25,000

- Fixed interest rates and monthly repayments

- Terms from 1 month to 5 years

- No upfront fees

- Bad credit considered

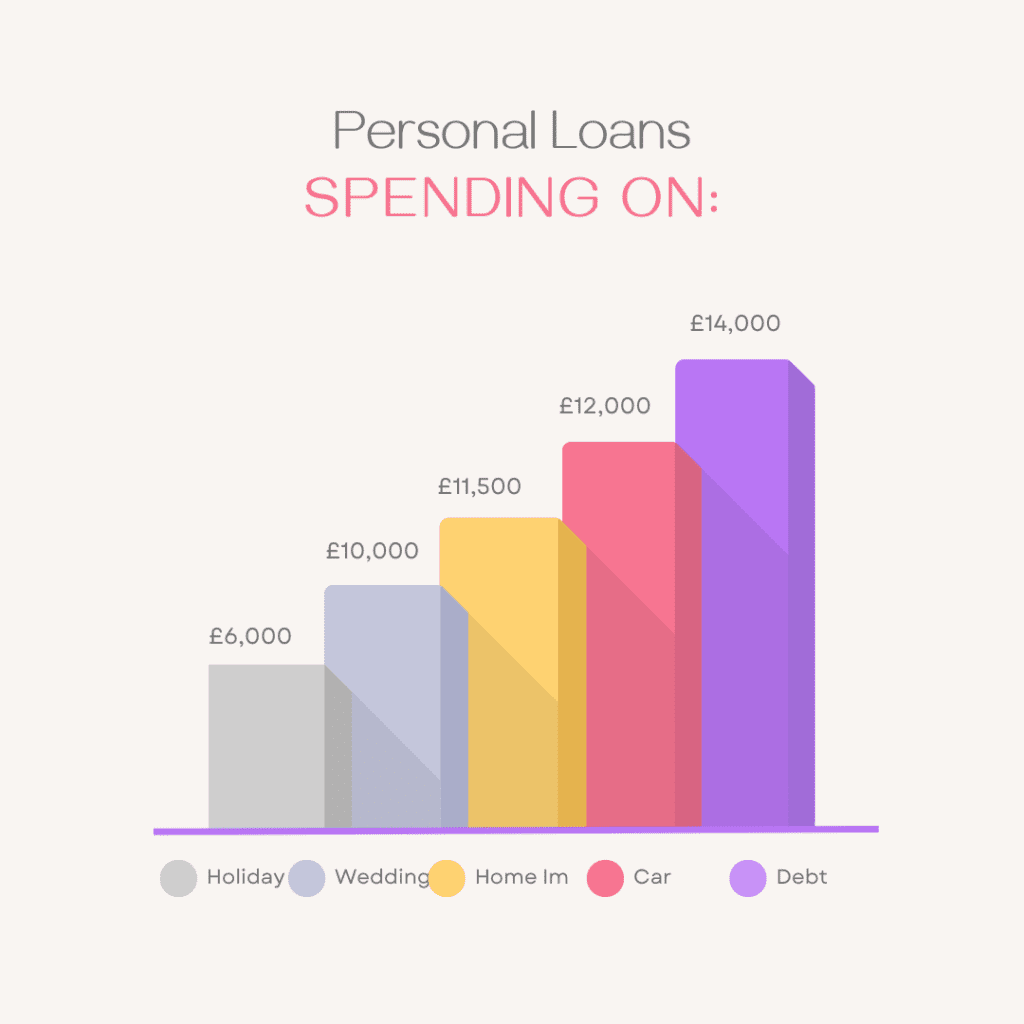

What Can You Use a Personal Loan For?

Personal loans are versatile and can be used for a wide variety of purposes, including:

- Debt Consolidation: Combine multiple debts into one manageable payment.

- Home Improvement: Make renovations or improvements to your home.

- Vehicle Purchase: Buy a new or used car without breaking your budget.

- Dream Holiday: Finance the vacation you’ve always wanted and pay it off over time.

- Wedding Expenses: Spread the cost of your big day with a manageable repayment plan.

Our helpful bar chart below gives you an idea of how much people are borrowing and what for. Based on feedback from our panel over the course of this year.

How Does a Personal Loan Work?

A personal loan is an unsecured loan, meaning you don’t need to offer collateral. Instead, your eligibility is based on your income and credit status. Once approved, you repay the loan in fixed monthly instalments over a set period.

How Can I Get the Best Personal Loan Rates?

Those customers with good credit scores will usually have access to the lowest rates. By having a history of paying off credit cards and loans on time, you would have built up a good credit score. This gives lenders confidence that you will be able to repay your loan and you will be rewarded with a lower rate.

Here’s how you can improve your credit score:

- Pay down existing debts and ensure timely payments on current loans or credit cards.

- Maintain low credit utilisation (keep balances under 30% of your credit limit).

- Close unused accounts to simplify your credit profile.

Pro Tip: Always aim to keep your credit utilisation between 20-30% to appear more favourable to lenders.

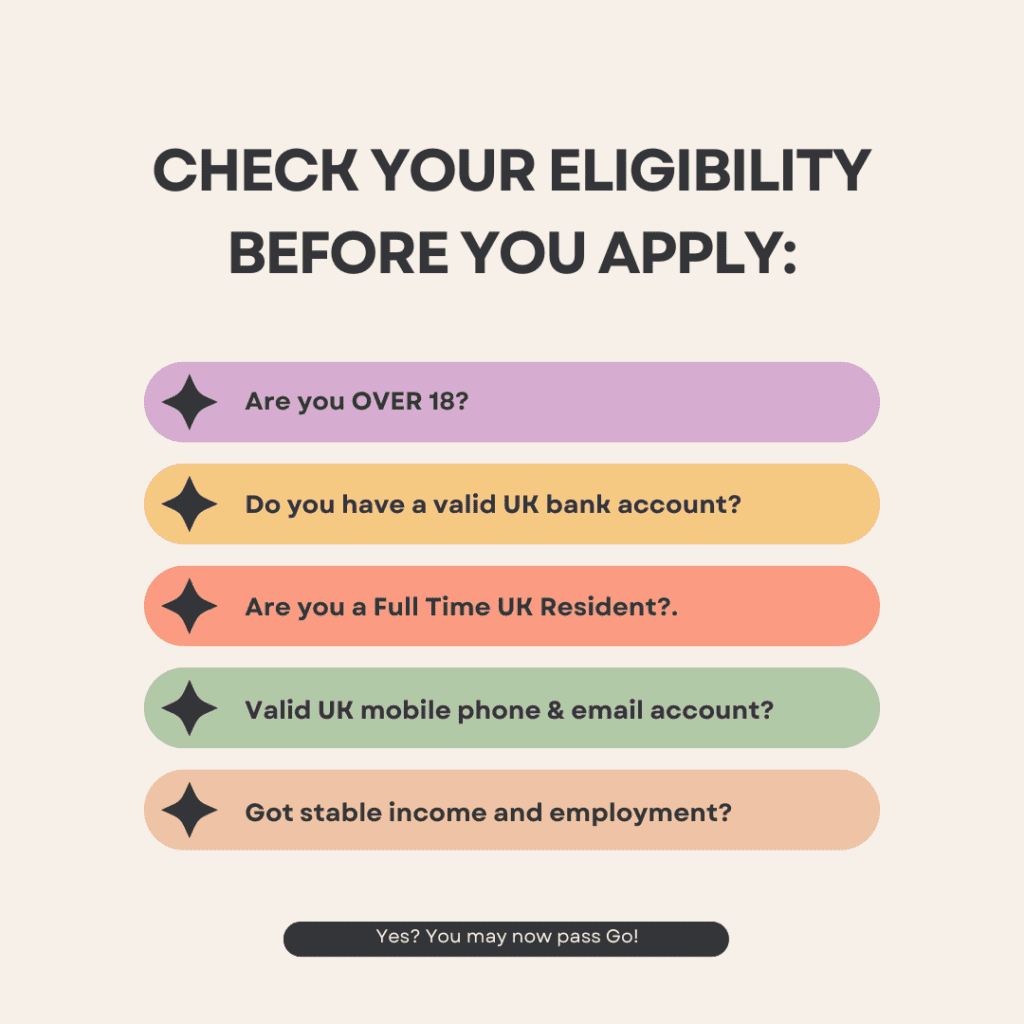

Other eligibility factors that will give you access better rates including having a regular, stable income and homeowner status.

Hungry for more information? We have another blog post about What To Consider Before Applying for a Personal Loan. You can read it by clicking on the highlighted text. If you are a home owner or have valuable collateral to use as security against your loan then have a look at our collateral loans page by clicking on the highlighted text.

Can I Get Personal Loans for Bad Credit?

Yes, people with bad credit can both apply for and get personal loans. The lenders on our panel appreciate that not everyone can have a perfect credit score. They also expect to see a few missed payments or the occasional default.

Although you may have a poor credit history, if you have made current payments on time for other types of loans or credit cards, the lender will appreciate that you are on the right track and will be able to pay future commitments.

If you have a very poor credit score, the interest rate may be slightly higher and the amount you wish to borrow many be less. This is so the lender can better manage their risk.

Why Apply for a Personal Loan with Badger Loans?

Apply for a loan with Badger Loans using our online application form. You can get an almost instant decision and a provisional loan approval in less than 5 minutes.

There are no upfront fees for applying and it will not impact your credit score. We simply require a few basic details about you, your address, income, the amount you wish to borrow and how long for.

Our loan matching system is able to pair your requirements with the lender most likely to accept your application and offer the best rate possible. To get an instant decision and provisional loan quote, simply click on the apply now button to get started. The application form takes less than 5 minutes to complete and you will have an answer on screen in under 2 minutes.

Successful customers can sometimes receive funds to their bank account in 1 hour or more usually within 24 hours of applying.

Frequently Asked Questions (FAQs)

What can I use a personal loan for?

You can use a personal loan for various purposes, including debt consolidation, home improvements, buying a car, or even funding a wedding or holiday.

How much can I borrow?

You can borrow from £1,000 to £25,000 with flexible terms ranging from 1 month to 5 years.

Does applying for a loan affect my credit score?

No, checking your eligibility through our quick application process won’t affect your credit score.

Can I repay my loan early?

Yes, you can repay your loan early at any time, and there are no penalties for doing so.

Badger Loans specialises in matching you with the best personal loans in the UK. With a quick application process, no upfront fees, and funds available in as little as 24 hours, we’re committed to providing you with the best loan experience.

If you are ready to get started go to the Apply Now box and complete our 2 minute application form.