We work with up to 30 direct lenders to give you access to the best payday loans on offer at the most affordable prices. Remember that your interest rate will depend on how well you’ve conducted past loans. The best rates go to the best payers. We try to match your application with the lender most likely to both approve you and offer you the best terms.

To apply for a payday loan today, simply click on apply now and complete our online application form. It shouldn’t take longer than 5 minutes to complete. If you are new to Payday Loans and lending in general we advise you to take a look at our recent complete guide to payday loans in the UK. If you love reading about Payday Loans (and who doesn’t?!) there’s another post here with 5 tips on getting the best payday loans on offer.

What is a Payday Loan?

Payday loans were originally designed to pay for any immediate bills last until your next ‘payday.’ The loans would only last for 2 to 4 weeks and you would repay in full the day you got paid your salary from work. Today, payday loans have become more like regular unsecured loans. Your loan is subject to status and does not require you put down any form of collateral.

Customers can apply for up to £25,000 through Badger Loans and receive an almost instant decision. Loans are available from 1-60 months. Subject to further checks, you could potentially receive funds within 1 hour or the same day of applying. More likely you will receive your money within 1-2 working days. To get money quickly your bank would need to use Faster Payments.

These days customers can apply for payday loans that are more flexible. You have the option to spread repayments over 1-60 months, giving you more breathing space.

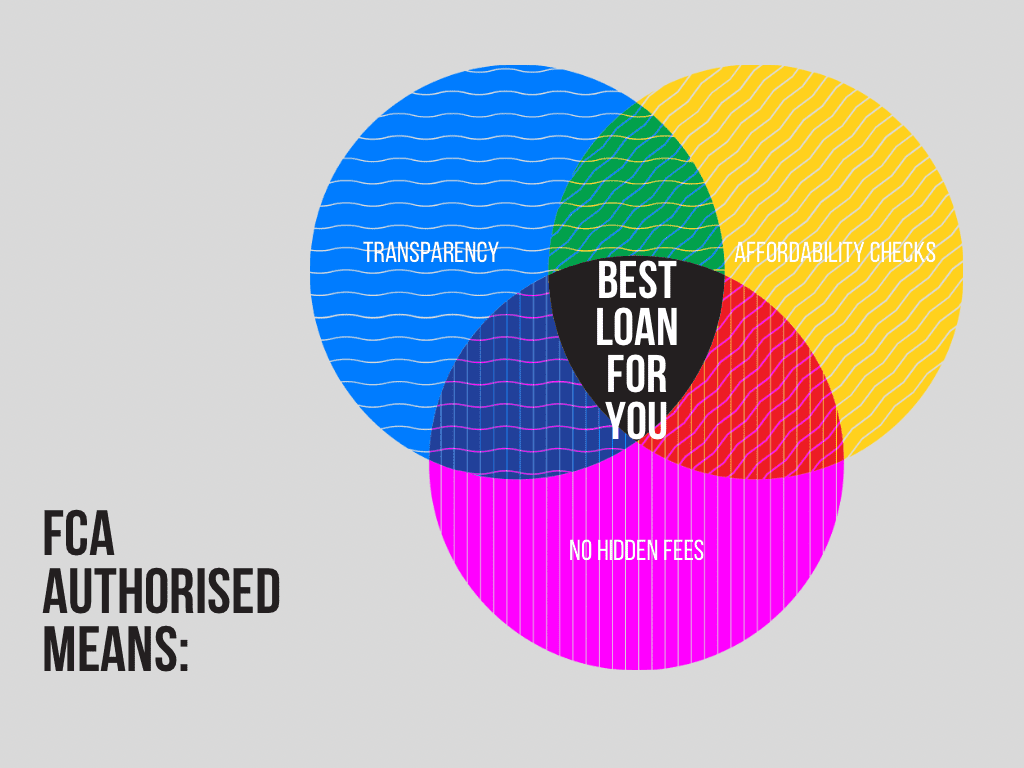

Badger Loans works with a list of direct, FCA authorised, payday lenders. This means you are able to receive funds and make repayments with a responsible, regulated lender. This also ensures that there are no upfront fees, hidden charges and your data is not passed onto multiple companies without your consent. Please always remember that payday loans are loans of last resort. You should try elsewhere first before applying and only apply after having made some crucial checks. Those checks include that you are on an FCA approved site and that you have checked all other avenues of finding money. Last but not least, NEVER take out a rollover loan, they are the loans that can trap you in debt for the next 20 years if you are not careful. Always repay one loan before taking out another.

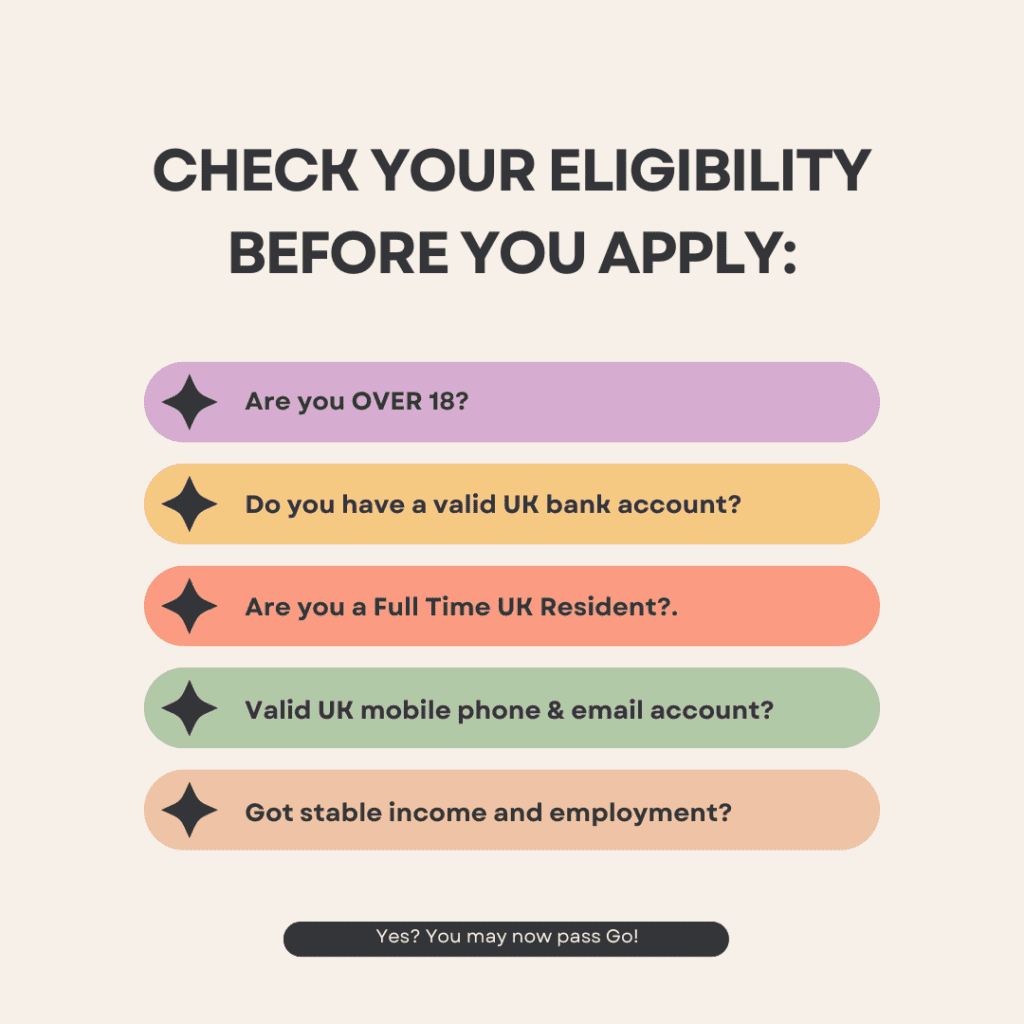

What is the Eligibility Criteria?

You are eligible for a payday loan if you:

- Are over 18 years old

- Are a full-time UK resident

- Have a regular income from employment

- Can afford monthly repayments

- Have a valid UK bank account and email address

Why Choose Badger Loans for Payday Loans?

- Wide Range of Lenders: We partner with 30+ FCA-regulated lenders, giving you access to a broad range of payday loan offers.

- Fast Approvals: Get a decision within minutes. Approved funds could be in your bank account within 1 hour or within 1-2 business days.

- Flexible Repayment Terms: Spread your repayments over 1 to 60 months, depending on the loan amount and your ability to repay.

- No Guarantor Required: You don’t need anyone else to sign for your loan. Our lenders offer payday loans without guarantors.

- No Hidden Fees: We ensure there are no upfront fees or hidden charges. Your loan terms will be fully transparent.

- No Impact on Credit Score: Our initial checks won’t affect your credit score.

- Competitive Interest Rates: Our system identifies the lender most likely to approve your loan and offer the lowest interest rate possible.

- Pay Early, Pay Less: You can repay your loan early at any time, saving on interest.

Apply for Payday Loans without a Guarantor

We offer payday loans on a no guarantor basis so you do not need an extra person to co-sign your loan agreement. You simply apply directly with the lender with no one else involved.

Not everyone wants to use a guarantor or have another person involved in their private finances. Hence, we offer a no guarantor payday loan so you can apply individually for your money.

How to Apply for a Payday Loan?

- Start Your Application: Click the ‘Apply Now’ button to fill out the online application form. This will take less than 5 minutes.

- Receive a Decision: Our system matches you with the lender best suited to your needs. Get a near-instant decision.

- Get Your Money: Once approved, funds will be sent to your bank account within 1 hour, or more commonly, within 1-2 days.

How Do Repayments Work for Payday Loans UK?

Payday loans are repaid in monthly instalments over the loan duration of 1 to 60 months. With equal repayments, you know exactly how much you are repaying in interest each month. Make sure you have enough money in your bank account ready for collection on the due date.

Collections are made via a process called continuous payment authority or direct debit. These automatically collect the exact amount owed each month from your bank account. This means that you do not have to make a manual payment, go to the bank or call up the lender as this is all taken care of.

You can choose which day you would like repayments to be made, with most customers using their payday from work. This is when they are mostly likely to have money in their account, whether it is the last working day of the month or a specific date.

You have the option to repay early at any time, just contact the lender to do so. You will often save money by repaying early since you are accruing less interest overall.

No Refusal Payday Loans UK Direct Lenders

The first thing we should do is clear up any misconceptions about the types of loans on offer here in the UK. Is it possible to get a ‘no refusal payday loan’ ? Unless a lender is offering Open Banking in place of a credit check, the answer is no. There are no lenders in the UK who offer loans on a ‘no refusal’ basis.

Like ‘no credit check’ loans and ‘guaranteed’ loans, they don’t exist either. As just stated, some lenders have chosen to use Open Banking in place of soft searches for their initial assessment. This gives them licence to use the phrase ‘no credit check loans’. Bear in mind they will still do a hard search before releasing any money. Payday loans have traditionally been easier to obtain than other loans due to their short term nature and willingness to lend by the lender. Please don’t let that confuse you with them being offered on a ‘no refusal’ basis though. You will still have to show you can afford the repayments, most likely prove your income and show an understanding of the product you are applying for.

Although payday loans can have higher acceptance rates compared to other loans, there is no such thing as ‘no refusal’.

Frequently Asked Questions

What is the interest rate for payday loans?

Interest rates vary by lender and depend on your financial situation. Our lenders offer rates between 12.9% APR and 1625.5% APR.

How quickly will I receive my loan?

Approved loans can be sent to your bank account within 1 hour, but most customers receive their money within 1-2 working days.

Can I repay my payday loan early?

Yes! Early repayments are allowed, and doing so may reduce the total interest you pay.

Are payday loans available for bad credit?

Yes, our lenders specialise in offering payday loans to those with poor credit scores.

That’s it! You have come to the end of our Payday Loans UK page. If you have read enough to make an informed decision go to the Apply Now button above and fill out our 2 minute application form. If successful a lender will be in touch pretty much straightaway and remember to NEVER give anyone money to complete an application.