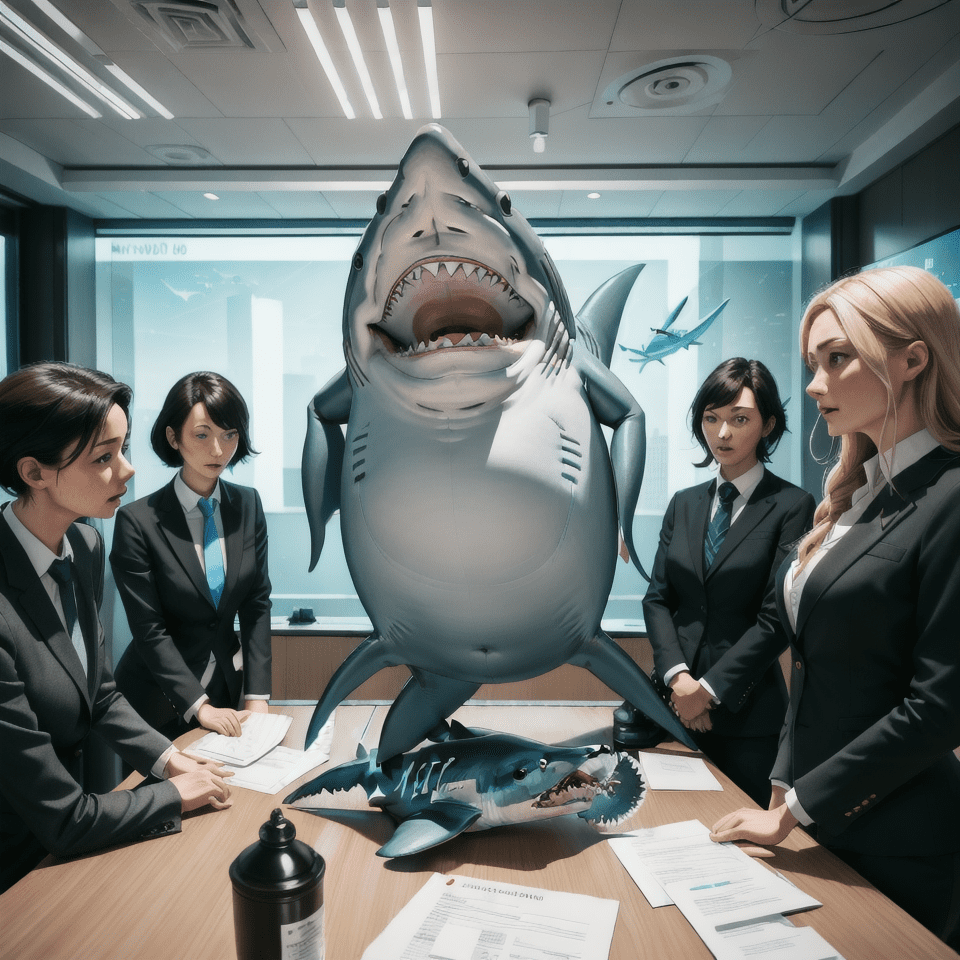

In an age where financial pressure is bearing down on millions, many turn to the internet looking for a fast solution, often in the form of a personal loan. The problem? A growing number of so-called “lenders” are nothing more than wolves in pinstripe suits. They look official, they sound convincing and they often borrow the identity of real, regulated companies (like ours!). Welcome to loan sharks in disguise – the rise of clone loan firms.

These operations are not run from a local pub or back alley. They’re hosted on slick websites, advertised on social media and sometimes they even send out professional-looking documents and contracts. The twist? They’re illegal. And worse, they’re on the rise.

What Exactly Is a Clone Loan Firm?

A clone firm is a scam operation that steals the identity of a legitimate, FCA-authorised business. They use the real firm’s company name, reference number and address, giving the impression of trustworthiness. They’ll often cold-call, send text messages or appear in online adverts offering loans with attractive rates and guaranteed acceptance — even for people with bad credit. Check out our experience with these scammers here: Don’t Get Scammed!

The catch? Before you can receive the loan, they’ll demand an “upfront fee”, supposedly for ‘bad credit’ insurance, processing or admin costs. Once you pay, the loan never arrives and the firm vanishes into the digital ether. Victims are sometimes too embarrassed or confused to report it and even when they do, the money is rarely recovered.

How Big Is the Problem?

According to the Financial Conduct Authority (FCA), reports of clone firm scams are surging and not just in the crypto space. In May 2025 alone, over 30 unauthorised financial firms were added to the FCA’s warning list, some of them posing as personal lenders. While cryptocurrency scams grab the headlines, these clone lenders are targeting everyday people such as workers, single parents, carers and pensioners. Often when they’re at their most financially vulnerable. If you’re in the process of applying for short term personal or payday loans then you probably are.

One of the biggest issues is visibility. A quick Google search for “bad credit loans” can turn up ads from clone firms who have paid to appear at the top. The FCA doesn’t control search engines and scammers are quick to buy new domains the moment one gets blacklisted.

Red Flags to Watch Out For

If it seems too good to be true, it probably is. Some of the most common warning signs include:

- Upfront fees: Legitimate lenders do not charge you money before paying out a loan.

- Pressure tactics: Urgency, threats of losing the “offer” or emotional manipulation are big red flags. As is rude and abusive language!

- No credit checks: Any firm promising loans without checking your credit file before lending is either lying or breaking the law. Or using Open Banking.

- Use of free email addresses: A legitimate financial company is unlikely to be emailing from a Gmail or Yahoo address.

- Unusual contact methods: WhatsApp messages, social DMs, or text-only interactions should be treated with suspicion.

- Requests to buy pre-paid cards. No broker or lender would ever do this.

How to Protect Yourself

Before dealing with any lender, verify them directly using the FCA Register. If the name, address, or contact details don’t match, walk away. Better still, check the FCA Warning List of scam firms updated regularly at fca.org.uk/scamsmart.

Also, remember: regulated lenders don’t ask for payment in advance. If someone does, report them, either to the FCA or via Action Fraud. Your report could stop others from falling into the same trap.

Why It Matters to Us

At Badger Loans, we’ve seen first-hand the damage these fraudsters cause. They prey on the desperate, the hopeful and the struggling. It’s exploitation, plain and simple. That’s why we’re making scam awareness a central part of this month’s newsletter, The Badger Bulletin — to arm you with the facts, so you can protect yourself and those around you.

And if you ever want a second opinion before applying for a loan? Ask us. No pressure, no pitch, just solid, informed guidance from someone who’s been in the game for decades. Email us at: [email protected]

Stay safe. Stay smart. And always check the badge.