Representative example: borrow £600 for 8 months. 1st monthly repayment of £144.38, 6 monthly repayments of £192.50, last monthly repayment of £96.25. Total repayment £1,369.63. Interest rate p.a. (fixed) 185.39%. Representative APR 611.74%. Our loans are available for 3 to 9 months depending on the loan amount — rates between 295.58% APR and a maximum APR of 1294%.

Representative example: borrow £600 for 8 months. 1st monthly repayment of £144.38, 6 monthly repayments of £192.50, last monthly repayment of £96.25. Total repayment £1,369.63. Interest rate p.a. (fixed) 185.39%. Representative APR 611.74%. Our loans are available for 3 to 9 months depending on the loan amount — rates between 295.58% APR and a maximum APR of 1294%.

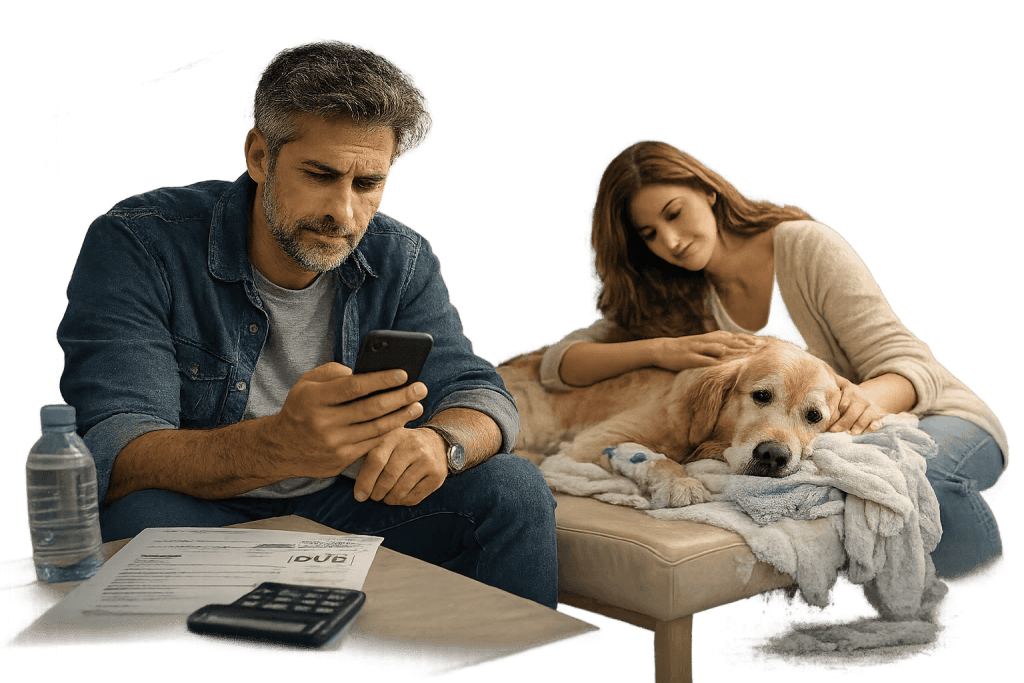

An emergency loan is designed for those “oh no” moments when the boiler dies in mid-winter, the car breaks down before work or an urgent bill you didn’t see coming… like when your beloved pet needs a life saving medical treatment today. Unlike standard personal or short term loans, the goal here is speed and simplicity. That’s where an emergency loan from Badger Loans can help. Our straightforward online application takes just a few minutes, and you’ll usually receive a decision within moments. If approved, the money can be in your account the very same day, helping you bridge the sudden gap in your unexpected financial need.

We know that not everyone has a perfect credit history and that’s okay. What matters most is your ability to repay the loan now, not your past mistakes. That’s why we look at the bigger picture when reviewing your application, not just your credit score. Whether you’re facing a temporary cash flow problem or need a little breathing room, Badger Loans is here to make the process fast, fair and stress-free.

Badger Loans works with a list of direct, FCA authorised, payday lenders. This means you are able to receive funds and make repayments with a responsible, regulated lender. This also ensures that there are no upfront fees or hidden charges and your data is not passed onto multiple companies without your consent. Please always remember that emergency loans are loans of last resort. You should try elsewhere first before applying and only apply after having made some crucial checks. Those checks include that you are on an FCA approved site and that you have checked all other avenues of finding money. Last but not least, NEVER take out a rollover loan, they are the loans that can trap you in debt for the next 20 years if you are not careful. Always repay one loan before taking out another.

Customers can apply for up to £15,000 through Badger Loans and receive an almost instant decision. Loans are available from 1-60 months. Subject to further checks, you could potentially receive funds within 1 hour or the same day of applying. More likely you will receive your money within 1-2 working days. To get money quickly your bank would need to use Faster Payments.

These days customers can apply for payday loans that are more flexible. You have the option to spread repayments over 1-60 months, giving you more breathing space.

If that sounds like you, you’re eligible to apply today!

Badger Loans works with a panel of up to 50 lenders in the UK. This helps you improve your chances of being approved for a short term loan and getting access to the funds you need faster. With each lender having different requirements, you can maximise your chances of approval through Badger Loans. Every lender on our panel has been reviewed and vetted to ensure that they are fully authorised, regulated and trustworthy. With no upfront fees, you can receive an almost instant decision in up to 5 minutes and if successful, can receive funds on the same day. Sometimes within a few hours. We will not pass on your information to any other companies without your permission.

Yes, you can still apply even if you have a poor credit history. At Badger Loans, we understand that life happens. Missed payments or financial hiccups in the past shouldn’t stop you from getting help when you need it most. Rather than focusing solely on your credit score, we look at your current circumstances, including your income and ability to repay the loan comfortably. Every emergency loan application is assessed on its own merits, so having bad credit doesn’t automatically mean you’ll be turned away.

Our goal is to offer fair and responsible lending to people from all walks of life. If you’re employed or have a steady income, you still have a strong chance of being approved, even if your credit isn’t perfect. And don’t worry, applying won’t affect your credit score, as we only run a soft check during the initial assessment.

Repayments for emergency loans are made in fixed monthly instalments over an agreed term — typically between 1 – 3 years. When you apply, you’ll choose how much you want to borrow and for how long, and you’ll see exactly what your monthly repayment will be before accepting the loan. When you apply, you’ll see the full cost of the loan upfront, with no hidden fees or surprises. Everything is clearly outlined so you know exactly what you’ll be repaying and when.

Repayments are typically collected automatically from your bank account using a Continuous Payment Authority (CPA), so there’s no need to worry about missing the due date. If you’re able to repay early, you can and that could save you money on interest. We always recommend borrowing only what you need and ensuring that the repayment fits comfortably within your budget. If you’re ever unsure or your circumstances change, we’re here to help.

Get your decision in minutes and, if approved, receive your funds within the hour. Applying won’t affect your credit score.

Yes, having bad credit does not necessarily disqualify you. Some lenders specialise in more flexible criteria. But you must be realistic: the higher your risk, the more cautious lenders will be. Always compare interest rates and read the terms before accepting.

In many cases, applicants who pass verification can receive funds within 24 hours. Some may be approved faster – even on the same day, but that depends on how complete and accurate your supporting documents are, your bank, and the lender’s processing capacity.

Common requirements include: proof of identity (passport or driving licence), recent payslips or bank statements as proof of income, proof of address (e.g. utility bill), and UK bank account details. Missing or inconsistent information is the main reason for delays.

Yes, most lenders require you to be 18 or older and to be a UK resident. You may also need to provide proof of address and identification as part of meeting regulatory requirements.

Emergency loans can sometimes carry higher APRs than standard short term or personal loans, due to the added risk and quick processing. Always check the Representative APR and total repayment cost. Under FCA rules, penalty fees for missed payments are capped to prevent abuse.

No. Genuine, regulated emergency loans must include a credit check. Be wary of lenders who advertise “no credit check” because these may be unregulated or predatory.

Communicate with your lender immediately. Many will offer extensions or adjusted repayment plans. Repeated defaults will harm your credit file and may increase debt. Avoid ignoring the issue.

Yes. Before borrowing, explore options like Budgeting Loans/Advances (if eligible) via the government, local council grants or hardship funds, charity assistance, or negotiating with creditors directly. (E.g. gov.uk has info on budgeting loans from benefits)

An emergency loan is short-term borrowing designed to cover urgent, unexpected costs such as car repairs, essential bills, boiler breakdowns or temporary income gaps. These loans prioritise speed and accessibility, with many lenders offering instant decisions and same-day payouts. Our Emergency Cash Guide in our Support Hub explains when these loans are appropriate and when other options may be better.

Yes, many lenders operate 24/7 and can release funds outside normal banking hours, depending on your bank’s Faster Payments support. Even with irregular income (freelance, zero-hours, self-employed), you may still qualify if affordability is clear. Check our Budget/Affordability Planner in the footer below to see what repayment level is realistic before applying.

Yes, most emergency loans are no guarantor loans. Lenders assess your own income and affordability rather than relying on someone else’s creditworthiness. This is especially useful if you need emergency cash fast and can’t ask anyone to guarantee the loan.

Lenders look at more than your credit score. For emergency loans with bad credit, they focus on income stability, recent bank statement activity and whether repayments are realistically manageable. Applicants with CCJs, defaults or missed payments may still qualify. See our Bad Credit Guide in the Support Hub for ways to improve your chances.

They’re intended for urgent, essential expenses and not luxuries or long-term financial commitments. Common uses include utility bills, rent shortfalls, medical or vet costs, unexpected travel or urgent home repairs. Our Money Management Guides help you decide when borrowing is appropriate.

Your initial application through Badger Loans uses a soft search, which does not affect your credit score. If you continue with a lender and accept their loan agreement, they will run a hard search. Using a broker helps avoid multiple hard searches, which can damage your credit if you apply everywhere separately.

Most lenders offering emergency loans provide instant decisions, often in minutes. If approved, payout can follow shortly after, sometimes within hours. Delays usually only happen if further verification is needed. Reading our blog post How the Badger Loans Application Process Works will help you avoid common issues that slow things down. You’ll find it in the Support Hub under Borrowing Basics.

They can be because they are designed for speed, convenience and higher-risk applicants. APRs on emergency cash loans tend to be higher than standard personal loans or credit cards but not always. It’s important to compare the total cost, as in the amount of interest paid over the course of the loan and not just the rate. Consider alternatives if the loan isn’t essential.

emergency loan company, need emergency money now uk bad credit, uk emergency loans, emergency money bad credit, loans like provident no credit check