Understanding Emergency Loans

Emergency loans are designed to provide quick financial relief during unexpected situations, such as medical emergencies or urgent home repairs. These loans typically offer fast approval and funding, making them an ideal solution for individuals facing immediate financial challenges.

These loans can vary in terms of amount, interest rates, and repayment terms. For example, some lenders may offer small amounts with higher interest rates, while others might provide larger sums with more favorable terms. It's essential to research different options and understand the implications of taking on such loans to ensure they align with your financial situation.

Exploring Personal Loan Options in the UK

Personal loans in the UK come in various forms and can be tailored to meet individual financial needs. They can be secured or unsecured, depending on whether collateral is required, and are used for purposes like home improvements, debt consolidation, or large purchases.

When considering personal loans, it's crucial to compare interest rates, terms, and fees from different lenders. This helps borrowers find the most suitable option for their financial circumstances. Additionally, understanding credit scores and how they impact loan eligibility can significantly influence the borrowing process.

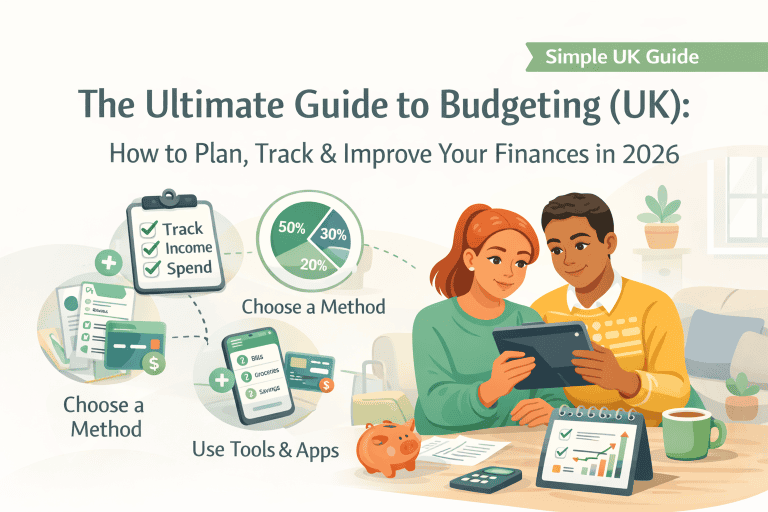

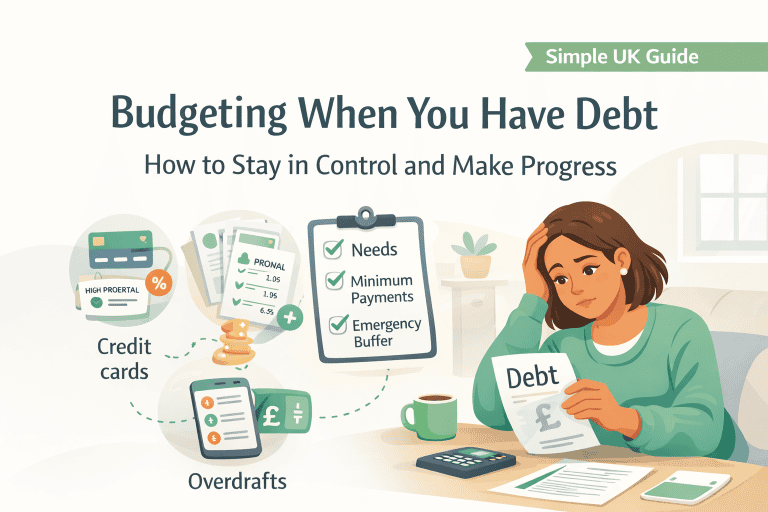

Tips for Managing Debt Effectively

Managing debt effectively is vital for maintaining financial health and achieving long-term stability. Strategies such as creating a budget, prioritizing high-interest debts, and considering debt consolidation can empower individuals to take control of their financial obligations.

Moreover, seeking professional financial advice can provide personalized strategies tailored to specific situations. Educational resources and tools, such as debt calculators, can also assist in tracking progress and making informed decisions about repayment plans.

The Impact of Financial Literacy on Borrowing Decisions

Financial literacy plays a crucial role in empowering individuals to make informed borrowing decisions. Understanding the terms and conditions of loans, interest rates, and repayment options can help borrowers avoid pitfalls associated with debt.

By improving financial literacy, individuals can better evaluate their options and choose loans that align with their financial goals. Resources such as workshops, online courses, and financial blogs can enhance knowledge and confidence in managing personal finances effectively.