Budgeting is one of the most practical financial skills you can learn and also teach your children. Whether you’re trying to regain control of your money, reduce debt, or plan ahead with confidence, a clear budget gives you visibility, stability, and choice.

This guide explains what budgeting is, why it matters, and how to do it properly, with links to deeper guides for each key area.

What Is Budgeting and Why It Matters

Budgeting is the process of planning how your money is earned, spent, saved, and allocated over time. A good budget reflects reality, not wishful thinking, and helps you make informed financial decisions.

Effective budgeting allows you to:

- Track your income and spending accurately

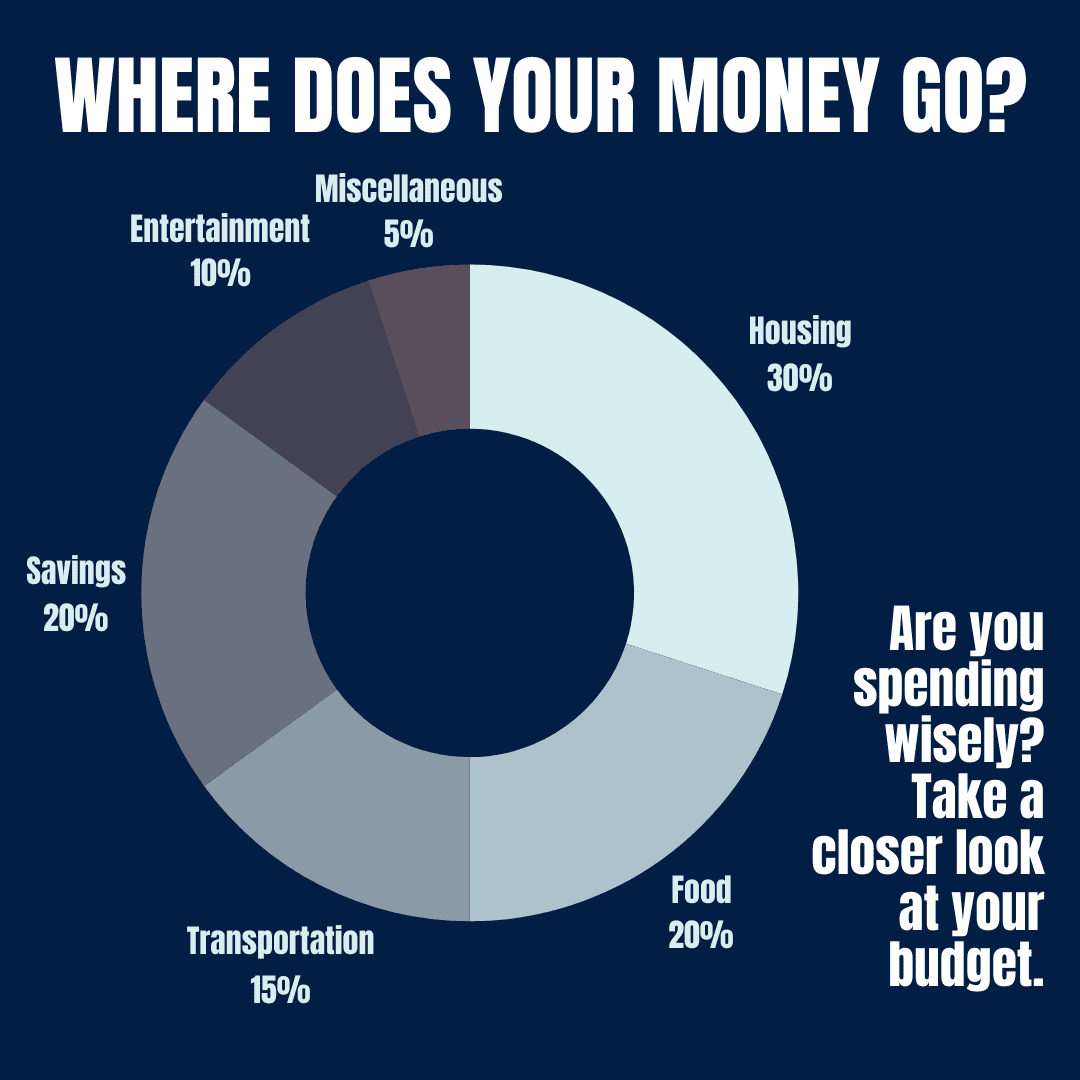

- Understand where your money is really going

- Identify areas where you can cut back or reallocate

- Plan for short- and long-term financial goals

- Prepare for unexpected expenses

- Reduce financial stress and uncertainty

Budgeting is not about restriction. It is about clarity and control— knowing what your money is doing so it supports your life rather than undermines it.

The Key Steps Involved in Budgeting (Overview)

In short:

Creating a budget involves tracking your income and expenses, categorising spending, identifying problem areas, setting realistic financial goals, and allocating money using a clear framework such as the 50/30/20 rule. A good budget is reviewed regularly and adjusted as circumstances change.

This overview explains what budgeting involves. For full, practical guidance on how to do it step by step, see the detailed guide below.

➡️ Learn more:

How to Create a Budget – A Detailed Step-by-Step Guide

Budgeting Methods Explained (Which One Is Right for You?)

Different budgeting methods suit different lifestyles and financial situations. There is no single “best” method — the right one is the one you can stick to.

Common budgeting methods include:

- 50/30/20 budgeting– simple and flexible

- Zero-based budgeting– every pound is assigned a job

- Envelope method– cash-based spending control

- Pay-yourself-first– savings prioritised automatically

Choosing the right method depends on how predictable your income is, how much structure you need, and whether debt repayment is a priority.

➡️ Learn more:

Budgeting Methods Explained

Budgeting Tools and Apps in the UK

You don’t need complicated software to budget effectively, but the right tools can make consistency much easier.

Common budgeting tools include:

- Spreadsheets(manual but highly flexible)

- Budgeting appswith Open Banking integration

- Banking toolsthat categorise spending automatically

- Pen and paperfor simple, visual tracking

The best tool is one you will actually use and review regularly.

➡️ Learn more:

Best Budgeting Tools in the UK

Budgeting When You Have Debt

Budgeting looks different when debt repayments are involved. The priority becomes balancing essential living costs while making consistent progress on what you owe.

Key principles include:

- Prioritising high-interest debt

- Maintaining minimum payments on all obligations

- Avoiding new debt while stabilising your finances

- Exploring consolidation or restructuring where appropriate

- Building a small emergency buffer to avoid reliance on credit

A realistic budget can make debt repayment feel manageable rather than overwhelming.

➡️ Learn more:

How to Budget When You Have Debt

Where to Get Help With Budgeting and Debt

If you’re struggling with your finances, support is available.

You may wish to:

- Seek free advice from organisations such as Citizens Adviceor National Debtline

- Speak with an Independent Financial Adviser for tailored guidance

- Contact lenders early if you’re having difficulty making payments

If borrowing is part of a wider financial plan, Badger Loansoffers unsecured loans for UK residents aged 18+, with fixed repayments and clear terms to support responsible borrowing. You can start by checking your eligibility using our free Budget and Affordability Calculator.

Conclusion

Budgeting is a practical skill that improves financial stability, reduces stress, and creates options. By understanding where your money goes and planning how it is used, you can make decisions that support both your present needs and future goals.

A good budgetis not static — it evolves as your circumstances change. With regular review and realistic planning, budgeting becomes a tool for confidence, not restriction.

Apply for a Loan with Badger Loans