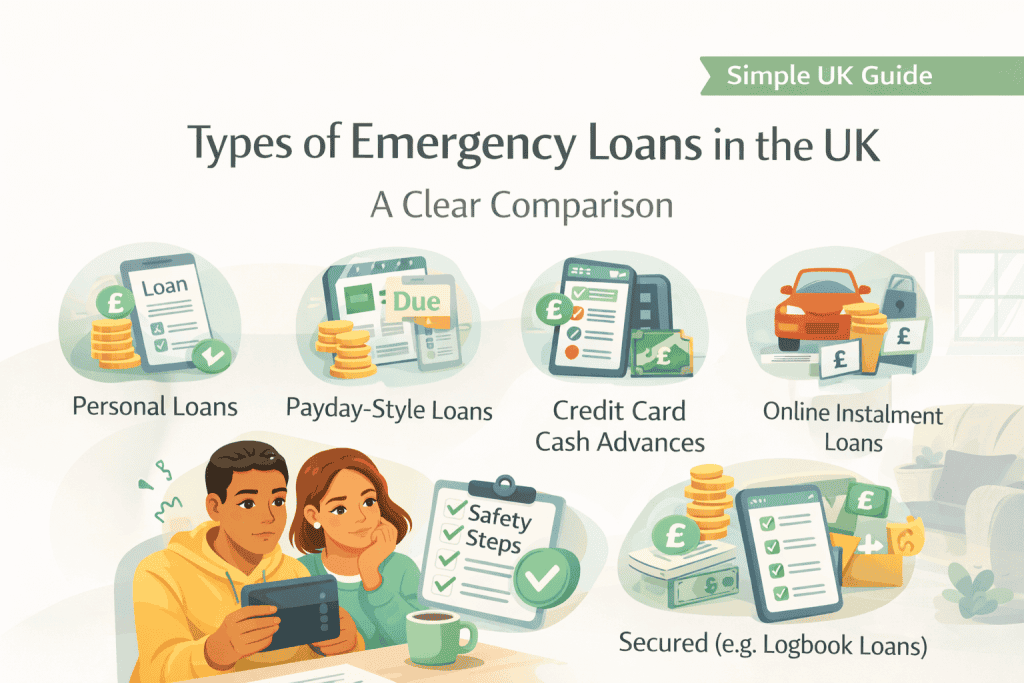

A Clear Comparison

“Emergency loan” is not a single product. In the UK, the term covers several different types of borrowing, including various types of emergency loans UK, each designed for different situations and levels of risk.

This guide explains the main types of emergency loans available, including the various types of emergency loans UK, how they work, and when each may — or may not — be appropriate.

1. Personal Loans

What they are

Unsecured personal loans repaid in fixed monthly instalments over an agreed period.

Typical features

- Lower interest rates than short-term or payday-style loans

- Fixed repayment schedule

- Usually require credit and affordability checks

When they may make sense

- You need emergency funds but can repay over time

- The cost is high enough to justify spreading repayments

When to avoid

- If you need money instantly and can’t wait for approval

- If poor credit leads to unaffordable rates

2. Short-Term / Payday-Style Loans

What they are

High-cost, short-term loans designed to be repaid quickly, often within weeks or months.

Typical features

- Fast approval and funding

- Higher interest rates

- Short repayment periods

When they may make sense

- A genuine, one-off emergency

- A small amount needed for a very short time

- You are confident you can repay on time

When to avoid

- If repayment would cause financial strain

- If you need ongoing support rather than a one-off solution

These loans are often described as a last resort.

3. Credit Card Cash Advances

What they are

Withdrawing cash using a credit card, either at an ATM or via a transfer.

Typical features

- Immediate access if you already have a card

- Higher interest rates than standard card purchases

- Cash-advance fees often apply

- Interest usually starts immediately

When they may make sense

- You need funds instantly

- You can repay quickly

When to avoid

- If you cannot clear the balance soon

- If fees and interest make the cost too high

4. Online Instalment Loans

What they are

Loans offered by online lenders, repaid in instalments over a short or medium term.

Typical features

- Fast application and approval

- Funding often same day or next working day

- Costs vary widely depending on credit profile

When they may make sense

- You want predictable repayments

- You qualify for a reasonable rate

When to avoid

- If the lender is unclear about costs

- If repayments stretch your budget

Always check total repayment amounts carefully.

5. Secured Emergency Loans (e.g. Logbook/Car Loans)

What they are

Loans secured against an asset, commonly a vehicle.

Typical features

- Faster access than traditional secured loans

- Lower rates than some unsecured options

- Risk of losing the asset if you cannot repay

When they may make sense

- You have no access to unsecured credit

- You understand and accept the risk

When to avoid

- For small, short-term cash needs

- If losing the asset would cause serious hardship

Secured borrowing carries significantly higher risk.

How to Choose the Right Type of Emergency Loan

When comparing options, consider:

- Speed: How quickly you need the money

- Cost: Total repayment, not just interest rate

- Repayment: Whether repayments fit your budget

- Risk: Especially where assets are involved

Borrowing faster usually means paying more.

Are All Emergency Loan Types Regulated?

In the UK, emergency loans must be offered by lenders regulated by the Financial Conduct Authority (FCA). Regulation requires:

- Affordability checks

- Transparent pricing

- Fair treatment of borrowers

Regulation helps protect consumers but does not remove the risk of borrowing.

If You’re Unsure

If none of these options feel suitable, it may be safer to explore alternatives first.

→ See: Alternatives to Emergency Loans in the UK

for lower-risk ways to manage urgent costs.

Key Takeaway

Different emergency loans suit different situations. The safest option is usually the one that:

- Meets the need

- Costs the least overall

- Can be repaid comfortably

Choosing carefully reduces both financial stress and long-term risk.