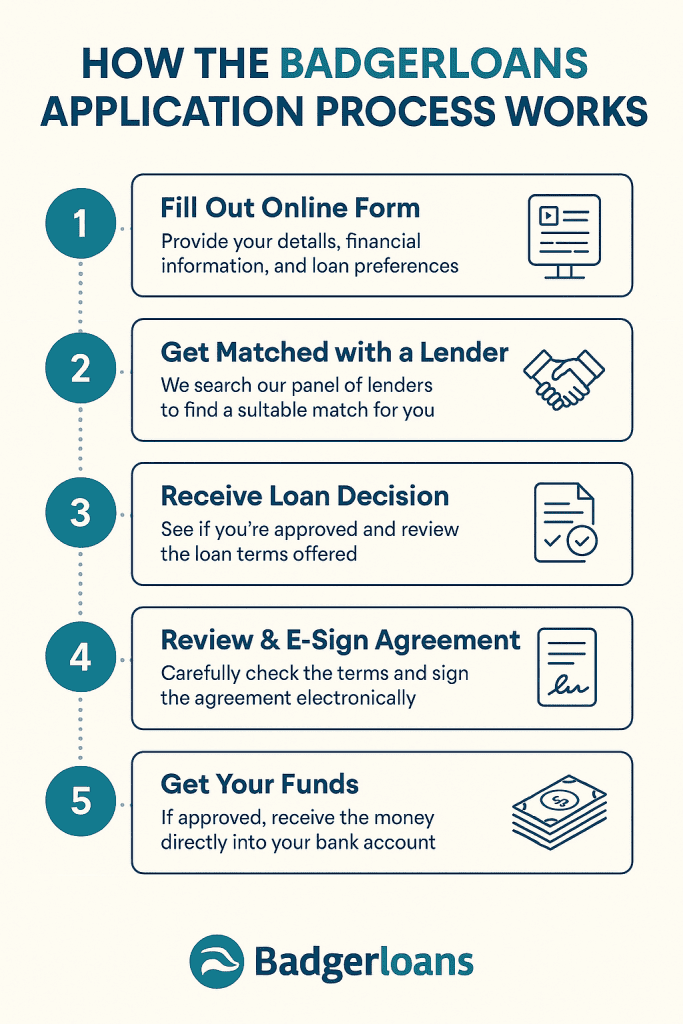

(And What to Expect)

Applying for a loan doesn’t need to be stressful. Here’s how we keep things simple.

Honest answers, quick checks, no confusing small print.

Applying for a loan can sound daunting, especially if you’ve been turned down before or you’re worried about your credit score. So we decided to help by showing you how the Badger Loans application process works and what you can expect from it once you begin to fill out our form.

At Badger Loans, we’ve built our application process to be as clear and fair as possible with no pushy sales talk, no fake promises and no upfront fees.

Here’s how it works, step by step.

Step 1: Tell us what you need

Start by choosing how much you’d like to borrow and what it’s for. Things like car repairs, home costs or covering a gap before payday.

We’ll ask a few simple questions about your income, job and general financial situation. It takes about two minutes and you can do it on your phone, tablet or laptop.

Step 2: We look for the best match

Once you hit “Submit,” our system instantly checks your details against a panel of trusted UK lenders. There’s no credit footprint at this stage as it’s what’s called a soft search, so it won’t affect your credit score. This is called a pingtree system and it’s used by pretty much every credit broker out there these days.

If we find a lender that looks like a good match, we’ll send you straight to their website to finish your application. You’ll see their offer and decide if it’s right for you. There’s never any obligation to accept.

(Learn more about our loan types and how they work.)

Step 3: You get a quick answer

Lenders usually reply within minutes. Some might ask for extra details, such as recent payslips or bank statements but many can make a decision based on your online form alone.

If approved, you’ll deal directly with the lender for the final paperwork and payout. Some pay out the same day; others might take a little longer depending on your bank.

Step 4: We keep it safe and fair

Every lender we work with is authorised and regulated by the Financial Conduct Authority (FCA). That means no hidden fees, no fake “guaranteed loans” and no cold calls.

If you ever get a message that looks suspicious or claims to be from us, you can double-check it on the FCA’s ScamSmart warning list.

Please remember that we are brokers trying to get you the best deal from up to 50 different lenders and other brokers. As such we must share your details with other FCA authorised responsible and trustworthy businesses. This will mean that after applying be prepared for an influx of marketing messages from panel lenders who want your business. This can be frustrating, especially if you didn’t get the loan you were after.

We sympathise but there really is no alternative and these days a quick hit of the unsubscribe button usually does the trick. There’s always the ‘block’ button if that doesn’t work first time!

Step 5: You stay in control

You’re free to walk away at any stage. We don’t hold your data hostage and we never charge you for using our site.

If you’re not approved right now, don’t lose heart, use our free Credit Repair Guide to tidy things up and try again later.

The Bottom Line

Our process is designed to be fast, fair and easy to understand.

You fill in one short form; we do the legwork. We don’t really, the algorithm does the ‘legwork’.

Whether you’re approved today or just getting started, we’ll help you find the right path, hopefully without stress and without strings attached.